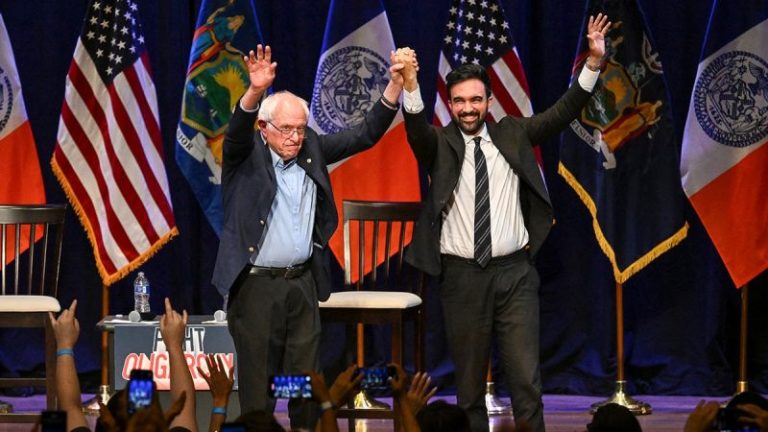

– Progressive stars Rep. Alexandria Ocasio-Cortez, D-N.Y., and Sen. Bernie Sanders, I-Vt., are teaming up with New York City mayoral candidate Zohran Mamdani Sunday night for a ‘New York is not for sale’ rally at Forest Hills Stadium in Queens, New York City.

The high-profile campaign event comes nearly one week before Election Day, as New Yorkers head to the polls for the first weekend of early voting, closing out a contentious mayoral battle where Mamdani’s unanticipated success has landed him on the national stage.

‘Zohran Mamdani is modeling a different kind of politics,’ Sanders, the former Democratic presidential candidate and longtime progressive leader, said in a statement ahead of the rally.

The trio of self-identified Democratic socialists have invigorated the Democratic Party’s progressive base at a time when Democrats are still grappling with devastating losses in 2024 amid growing discontent with President Donald Trump’s sweeping, second-term agenda.

When Sanders and Ocasio-Cortez teamed up for the ‘Fighting Oligarchy’ tour earlier this year, they sparked sizable buzz, firing up thousands of Democrats at rallies across the United States who had been left without a clear party leader.

‘As mayor, he will not run a top-down, billionaire-funded, consultant-driven administration. Instead, Zohran will be a champion for the working people of New York,’ Sanders said.

Both Sanders and Ocasio-Cortez have campaigned alongside Mamdani in his bid to lead the nation’s most populous city.

On Friday night, Sanders appeared for a virtual ‘Get Out the Vote’ event with Mamdani. Last month, Sanders and Mamdani teamed up for a ‘Fighting Oligarchy’ town hall in Brooklyn.

Ahead of the Brooklyn town hall event, the two progressive leaders marched alongside union members in Manhattan’s Labor Day parade. That afternoon, Mamdani posed for a photo with Sanders and Ocasio-Cortez in Astoria, Queens, amassing millions of views.

Sanders, a two-time Democratic presidential nominee runner-up, was an early endorser of Mamdani’s primary campaign, along with Ocasio-Cortez. Their endorsements helped Mamdani consolidate progressive support in the 11-candidate field during the final weeks of the primary race.

Mamdani’s primary upset triggered a political earthquake as the democratic socialist handily defeated former Gov. Andrew Cuomo, who was widely expected to secure the Democratic nomination.

Mamdani’s cross-endorsement with fellow progressive New York City Comptroller Brad Lander cleared the path for Mamdani to consolidate support against Cuomo through ranked-choice voting.

Cuomo has since launched an independent campaign, teeing up a competitive and contentious general election battle.

Since Mamdani secured the Democratic nomination, Trump has labeled him a ‘100% Communist Lunatic,’ and ‘my little communist,’ ushering Mamdani onto the national political stage. Mamdani has rejected the moniker, maintaining that he identifies as a democratic socialist, like Sanders and Ocasio-Cortez.

As Trump began criticizing Mamdani, New York Democrats chose to withhold their endorsements of the socialist candidate, who has made a slew of ambitious campaign promises, like fast and free buses, city-run grocery stores and free childcare, all of which he plans to pay for by raising taxes on corporations and the top 1% of New Yorkers.

After months of withholding their endorsements, Gov. Kathy Hochul finally endorsed Mamdani last month and House Minority Leader Hakeem Jeffries finally affirmed his support in a statement Friday. Senate Minority Leader Chuck Schumer has still yet to endorse.

Pressure had been mounting since Mamdani won the Democratic primary in June for Mayor Eric Adams, who was also running as an independent, or Cuomo to drop out of the race to consolidate support against Mamdani. Adams dropped out of the race and endorsed Cuomo on Thursday.

That pressure reached a boiling point last week as billionaires, including Red Apple Media CEO John Catsimatidis and hedge fund CEO Bill Ackman, called on Republican nominee Curtis Sliwa to drop out of the race in order to clear a pathway to victory for Cuomo.

The latest Fox News survey, conducted Oct. 10-14, ahead of the first general election debate last week, revealed that Mamdani has a substantial lead in the race. According to the poll, Mamdani has a 21-point lead among New York City registered voters with 49% of voters backing Mamdani, while 28% go for Cuomo and 13% favor Sliwa.

Mamdani also rose above the 50% threshold among likely voters, garnering 52% support, while Cuomo picked up 28%, and Sliwa received just 14%.

This post appeared first on FOX NEWS