- High-grade gold intercepts highlighted by 15.5 m at 2.30 g/t Au, incl. 8.3 m at 3.43 g/t Au at the Road Cut Zone

- Initial drilling on the gap between Jagger and Road Cut Zone confirms target structure, warrants further testing

- Current drill phase complete; Geological modelling and planning underway for 15,000 m drill program expected to begin in H2 2025

Kobo Resources Inc. (‘ Kobo’ or the ‘ Company ‘) ( TSX.V: KRI ) is pleased to report additional diamond drill results from the Road Cut Zone at its 100%-owned Kossou Gold Project (‘ Kossou ‘) in Côte d’Ivoire. Results from these holes continue to strengthen the Company’s understanding of the key structural controls that define this prospective target area.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250710272213/en/

Figure 1: Road Cut Zone Drill Hole Locations and Simplified Geology

The Company also completed an initial test of the gap between the Road Cut and Jagger Zones, confirming the presence of the interpreted structure. Additionally, the Company has provided an outline of its next exploration priorities as it advances plans for its next phase of drilling and regional target work.

Diamond Drill Results – Highlights:

Road Cut Zone:

- KDD0088

- 3.5 metres (‘m’) at 2.33 g/t Au from 81.0 m

- 1.0 m at 3.32 g/t Au from 119.0 m

- KDD0090

- 9.75 m at 1.69 g/t Au from 67.25, including 5.10 m at 2.93 g/t Au, from 68.9 m and 1.0 m at 11.30 g/t Au from 68.9 m, and

- 11.0 m at 2.88 g/t Au from 140.0 m, including 3.0 m at 8.25 g/t Au from 143.0 m

- KDD0091

- 5.0 m at 3.05 g/t Au from 28.0 m

- 15.5 m at 2.30 g/t Au from 123.0 m, including 8.0 m at 3.43 g/t Au from 126.0 m

- KDD0092

- 6.0 m at 2.05 g/t Au from 88.0 m

- KDD0093

- 6.0 m at 1.58 g/t Au from 76.0 m

- 7.95 m at 0.43 g/t Au from 106.0 m

Edward Gosselin, CEO and Director of Kobo commented: ‘Our latest drilling has outlined additional strong gold mineralization at the Road Cut Zone, highlighting its scale and the consistency of grades and widths we are seeing along strike and down dip. Importantly, these results build on our understanding of the structural setting at Kossou and will help guide how we advance the Road Cut Zone in parallel with the Jagger Zone, including the structural corridor between the two targets.’

He continued: ‘With this phase of diamond drilling now complete, our team is focused on advancing a larger, systematic program to further define the Jagger, Road Cut and Contact Zones, test the potential connection of the gap between these Jagger and Road Cut Zones, and expand our footprint to new targets identified at the Jagger South area and the underexplored western portion of the permit. Based on the work completed to date, we remain confident in the scale and continuity of mineralization at Kossou and believe the project continues to demonstrate significant potential as we move towards the next phase of drilling and a maiden Mineral Resource Estimate.’

Road Cut Zone Results

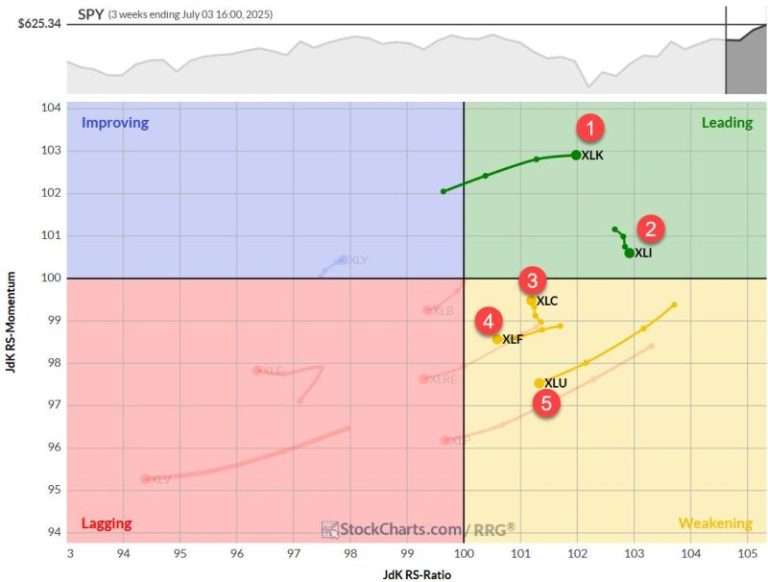

Results from six diamond drill holes at the Road Cut Zone have been received. Holes KDD0088 to KDD0090 were drilled on three sections (RCZ725 to RCZ775) (see Figure 1) to test gold mineralization associated with diamond drill hole KDD0056 , which previously returned 10.0 m at 4.57 g/t Au ( see press release dated January 30, 2025 ).

KDD0090 intersected two zones of strong gold mineralization: an upper intercept of 9.75 m at 1.69 g/t Au , including 1.0 m at 11.20 g/t Au , highlighting the high-grade nature of the cross-cutting V2 veins within the dominant northerly trending shear systems. The second intercept, 11.0 m at 2.88 g/t Au from 140.0 m, including 3.0 m at 8.25 g/t Au from 143.0 m, supports the continuity of high-grade mineralization within a previously identified structure (see Figure 2). Results from KDD0088 and KDD0089 , which returned 3.5 m at 2.33 g/t Au from 81.0 m, illustrate the variability of gold grades within the well-defined shear zones at the Road Cut Zone. These mineralised zones remain open at depth and will be targeted in future drilling.

A second set of holes, KDD0091 to KDD0093 (see Figure 3), targeted an area of artisanal mining previously trenched and sampled by the Company, which returned strong gold mineralization including trench KTR070 with 28.0 m at 4.44 g/t Au and trench KTR069 with 6.0 m at 2.50 g/t Au ( see press release dated December 5, 2023 ). Previous diamond drilling on this target also confirmed strong mineralization, including hole KDD0012 , which intersected 11.0 m at 1.71 g/t Au from 50.0 m ( see press release dated July 11, 2024 ).

All drill holes intersected significant gold mineralization, highlighted by KDD0091 , which returned 15.55 m at 2.30 g/t Au from 123.0 m, including 8.30 m at 3.43 g/t Au from 126.0 m. The mineralized zone is characterized by strong shearing within the basaltic host rocks, cross-cut by a series of V2 and V1 veins that are strongly altered and host gold mineralization that was consistent throughout the interval. This zones shows excellent continuity from surface down dip on the section RCZ500 (see Figure 4). Additional drilling is being planned to test these structures to the north and south along strike of shear zone and to depth.

Testing Structural Corridor Between Jagger and Road Cut Zones

One hole, KDD0087 , was drilled within the interpreted structural corridor between the Road Cut and Jagger Zones. The hole intersected a well-defined shear zone near surface but did not return significant gold mineralization. The presence of the shear structure provides further support for Kobo’s geological interpretation in this area. Additional drilling is planned to continue assessing the potential structural linkages and mineralization continuity between these two high-priority targets.

Soil Geochemistry to Define Targets: South Jagger and Western Kossou Permit Area

The Company has extended detailed infill soil geochemistry across the South Jagger Zone, collecting 270 samples to date. Previous infill sampling on a 25 m by 25 m grid proved effective in defining drill-ready targets at the Road Cut, Jagger and Kadie Zones further north. The South Jagger soil anomaly, which consistently returned values up to 1000+ ppb Au, now extends over a distance greater than 2 km, reinforcing its potential for follow-up drilling.

In addition, recent soil geochemical surveying has outlined a new northwest-trending anomaly of over 400 m in the western portion of the Kossou Permit, with individual sample results returning values up to 1,380 ppb gold. These results further support systematic target definition and demonstrate the upside potential across less-explored portions of the permit.

Update on Regional Exploration: Kotobi Permit

At the Kotobi Permit, the Company has collected 1,942 soil samples to date, with additional results pending. Recent work has defined a 50+ ppb gold-in-soil anomaly extending over 400+ m of strike length, with individual samples returning between 370 ppb and 1,420 ppb Au. Follow-up pitting and trenching are currently underway to better define this anomaly and assess its potential for future exploration work.

Earn-In Agreement: NESDAVE MINING

Regional scale soil geochemical sampling is underway at the Akoboissue Permit (PR0970). Information meetings are underway with local village chiefs and elders with respect to the Annépé Permit (PR0973) and regional scale soil geochemical sampling is expected begin shortly.

Next Steps: Preparing for Expanded Drilling and maiden Mineral Resource Estimate at Kossou

With this current phase of drilling now complete, the Company’s exploration and technical team is integrating the latest drill data into detailed geological models to refine its understanding of the structural controls at the Jagger and Road Cut Zones. This work will directly inform the Company’s next major drill campaign, which is anticipated to comprise more than 15,000 m of additional diamond drilling and begin in H2 2025. This expanded program will prioritize systematic step-out and deeper drilling at the Jagger Zone to support preliminary resource modelling, continue expansion drilling at the Road Cut Zone, and follow up on the interpreted structural corridor between the two zones.

Further, the Company plans to advance the Contact Zone with targeted drilling based on structural mapping completed to date and begin testing new targets on the western side of the Kossou Permit, supported by recent soil geochemical results indicating a strong northwest-trending gold anomaly. This methodical approach is designed to build on the Company’s drilling success to date, advance the potential for a future maiden Mineral Resource Estimate, and support the Company’s broader strategy to unlock value within Côte d’Ivoire’s highly prospective Birimian gold belt.

Table 1: Summary of Significant Diamond Drill Hole Results

|

BHID

|

East

|

North

|

Elev.

|

Az.

|

Dip

|

Length

|

|

From (m)

|

To

(m)

|

Int.

(m)

|

Au

g/t

|

Target

|

|

KDD0087

|

228681

|

775702

|

278

|

70

|

-50

|

113.00

|

|

NSR

|

|

|

|

Jagger

|

|

KDD0088

|

228495

|

775956

|

289

|

70

|

-50

|

173.00

|

|

55.00

|

57.00

|

2.00

|

0.88

|

RCZ

|

|

|

|

|

|

|

|

|

|

81.00

|

84.50

|

3.50

|

2.33

|

RCZ

|

|

|

|

|

|

|

|

|

|

119.00

|

120.00

|

1.00

|

3.32

|

RCZ

|

|

|

|

|

|

|

|

|

|

143.00

|

144.00

|

1.00

|

1.61

|

RCZ

|

|

KDD0089

|

228487

|

775979

|

283

|

70

|

-50

|

179.00

|

|

59.00

|

62.00

|

3.00

|

0.56

|

RCZ

|

|

KDD0090

|

228500

|

775931

|

294

|

70

|

-50

|

182.00

|

|

67.25

|

77.00

|

9.75

|

1.69

|

RCZ

|

|

|

|

|

|

|

|

|

incl.

|

68.90

|

74.00

|

5.10

|

2.93

|

RCZ

|

|

|

|

|

|

|

|

|

incl.

|

68.90

|

70.00

|

1.00

|

11.20

|

RCZ

|

|

|

|

|

|

|

|

|

|

104.00

|

105.00

|

1.00

|

1.67

|

RCZ

|

|

|

|

|

|

|

|

|

|

140.00

|

151.00

|

11.00

|

2.88

|

RCZ

|

|

|

|

|

|

|

|

|

incl.

|

140.00

|

146.00

|

6.00

|

4.66

|

RCZ

|

|

|

|

|

|

|

|

|

incl.

|

143.00

|

146.00

|

3.00

|

8.25

|

RCZ

|

|

KDD0091

|

228480

|

776270

|

244

|

70

|

-50

|

161.00

|

|

28.00

|

33.00

|

5.00

|

3.05

|

RCZ

|

|

|

|

|

|

|

|

|

|

123.00

|

138.55

|

15.55

|

2.30

|

RCZ

|

|

|

|

|

|

|

|

|

incl.

|

126.00

|

138.55

|

12.55

|

2.77

|

RCZ

|

|

|

|

|

|

|

|

|

incl.

|

126.00

|

134.30

|

8.30

|

3.43

|

RCZ

|

|

KDD0092

|

228529

|

776261

|

226

|

70

|

-50

|

116.00

|

|

88.00

|

94.00

|

6.00

|

2.05

|

RCZ

|

|

|

|

|

|

|

|

|

|

104.00

|

106.00

|

2.00

|

0.67

|

RCZ

|

|

|

|

|

|

|

|

|

|

112.00

|

115.00

|

3.00

|

0.76

|

RCZ

|

|

KDD0093

|

228510

|

776307

|

225

|

70

|

-50

|

116.00

|

|

76.00

|

82.00

|

6.00

|

1.58

|

RCZ

|

|

|

|

|

|

|

|

|

|

106.05

|

114.00

|

7.95

|

0.43

|

RCZ

|

|

Notes:

Cut-off using 2.0 m at 0.30 g/t Au

Intervals are reported with no more than 3 m of internal dilution of less than 0.3 g/t Au except where indicated*

|

An accurate dip and strike and controls of mineralisation are unconfirmed and mineralised zones are reported as downhole lengths. Drill holes are planned to intersect mineralised zones perpendicular to interpreted targets. All intercepts reported are downhole distances.

Sampling, QA/QC, and Analytical Procedures

Drill core was logged and sampled by Kobo personnel at site. Drill cores were sawn in half, with one half remaining in the core box and the other half secured into new plastic sample bags with sample number tickets. Core samples are drilled using HQ core barrels to below the level of oxidation and then reduced to NQ core barrels for the remainder of the bore hole. Samples are transported to the SGS Côte d’Ivoire facility in Yamoussoukro by Kobo personnel where the entire sample was prepared for analysis (prep code PRP86/PRP94). Sample splits of 50 grams were then analysed for gold using 50g Fire Assay as per SGS Geochem Method FAA505. QA/QC procedures for the drill program include insertion of a certificated standards every 20 samples, a blank every 20 samples and a duplicate sample every 20 samples. All QAQC control samples returned values within acceptable limits.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Paul Sarjeant, P.Geo., who is a Qualified Persons as defined in National Instrument 43-101. Mr. Sarjeant is the President and Chief Operating Officer and Director of Kobo.

About Kobo Resources Inc.

Kobo Resources is a growth-focused gold exploration company with a compelling new gold discovery in Côte d’Ivoire, one of West Africa’s most prolific and developing gold districts, hosting several multi-million-ounce gold mines. The Company’s 100%-owned Kossou Gold Project is located approximately 20 km northwest of the capital city of Yamoussoukro and is directly adjacent to one of the region’s largest gold mines with established processing facilities.

With over 18,500 metres of diamond drilling, nearly 5,900 metres of reverse circulation (RC) drilling, and 5,900 metres of trenching completed since 2023, Kobo has made significant progress in defining the scale and prospectivity of its Kossou’s Gold Project. Exploration has focused on multiple high-priority targets within a 9+ km strike length of highly prospective gold-in-soil geochemical anomalies, with drilling confirming extensive mineralisation at the Jagger, Road Cut, and Kadie Zones. The latest phase of drilling has further refined structural controls on gold mineralisation, setting the stage for the next phase of systematic exploration and resource development.

Beyond Kossou, the Company is advancing exploration at its Kotobi Permit and is actively expanding its land position in Côte d’Ivoire with prospective ground, aligning with its strategic vision for long-term growth in-country. Kobo remains committed to identifying and developing new opportunities to enhance its exploration portfolio within highly prospective gold regions of West Africa. Kobo offers investors the exciting combination of high-quality gold prospects led by an experienced leadership team with in-country experience. Kobo’s common shares trade on the TSX Venture Exchange under the symbol ‘KRI’. For more information, please visit www.koboresources.com .

NEITHER THE TSXV NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSXV) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Statement on Forward-looking Information:

This news release contains ‘forward-looking information’ and ‘forward-looking statements’ (collectively, ‘forward-looking statements’) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as ‘expects’, or ‘does not expect’, ‘is expected’, ‘anticipates’ or ‘does not anticipate’, ‘plans’, ‘budget’, ‘scheduled’, ‘forecasts’, ‘estimates’, ‘believes’ or ‘intends’ or variations of such words and phrases or stating that certain actions, events or results ‘may’ or ‘could’, ‘would’, ‘might’ or ‘will’ be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; and the delay or failure to receive board, shareholder or regulatory approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Except as required by law, Kobo assumes no obligation and/or liability to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250710272213/en/

For further information, please contact:

Edward Gosselin

Chief Executive Officer and Director

1-418-609-3587

ir@kobores.com

Twitter: @KoboResources | LinkedIn: Kobo Resources Inc.