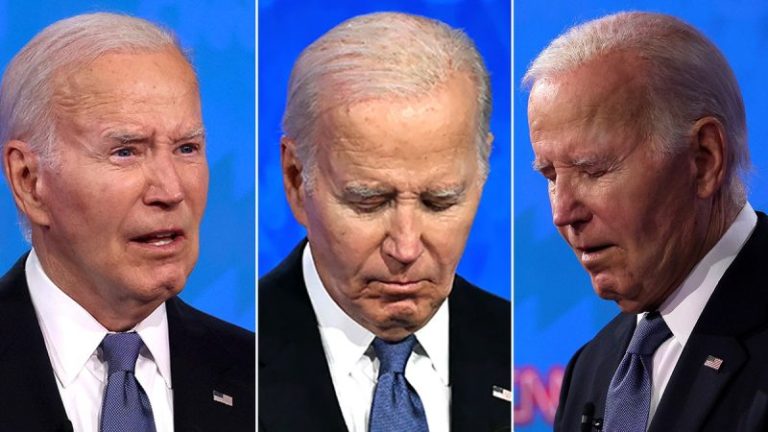

A year ago Friday, President Joe Biden took the debate stage against then-Republican presidential candidate Donald Trump and drove one of the final nails in his reelection campaign’s coffin as traditional allies turned their backs on the 46th president and subsequently rallied to replace him as the frontrunner against Trump.

Biden entered the reelection cycle already racked by claims and concerns that his mental acuity had slipped and he was not mentally fit to continue serving as president, which was underscored by special counsel Robert Hur’s report in February 2024 that rejected criminal charges against Biden for possessing classified materials, citing he was ‘a sympathetic, well-meaning, elderly man with a poor memory.’

The then-president spent days preparing for the debate from Camp David in Maryland, as videos of his recent public gaffes and missteps haunted the campaign in the days leading up to the debate. Trump, meanwhile, led the charge in demanding Biden take a drug test to prove he was not taking performance-enhancing supplements ahead of the highly anticipated event.

Biden brushed off accusations he was using any performance-enhancing supplements, including mocking Trump’s challenge that he take a drug test in an X post showing him drinking a can of water.

‘I don’t know what they’ve got in these performance enhancers, but I’m feeling pretty jacked up. Try it yourselves, folks. See you in a bit,’ the X post read, accompanied by a photo of Biden drinking a can of water that read ‘Get real, Jack. It’s just water.’

Just minutes later, Biden would deliver a failing debate performance that unleashed panic among the Democratic Party, as some rushed to defend Biden, and others broke with the man who had served in public office for more than 50 years to demand fresh leadership at the 11th hour of the campaign cycle.

‘I really don’t know what he said at the end of that sentence, I don’t think he knows what he said either,’ Trump shot at Biden at one point during the debate.

The viral moment followed Biden attempting to tout Congress’ bipartisan border package that lawmakers had bucked earlier in 2023.

Biden said, ‘We find ourselves in a situation where when he was president, he was separating babies from their mothers put them in cages, making sure that the families were separated.’

‘That’s not the right way to go. What I’ve done since I’ve changed the law, what’s happened? I’ve changed it in a way that now you’re in a situation where there are 40% fewer people coming across the border illegally, that’s better than when he left office. And I’m going to continue to move until we get the total ban on the total initiative relative to what we can do with more Border Patrol and more asylum officers,’ Biden said, appearing to trail off.

Overall, Biden’s 90-minute performance was riddled with him tripping over his words, speaking in a far more subdued tenor than during his vice presidency, having a raspy and unsure voice, and losing his train of thought at times.

Biden and Trump also were both confronted over their ages during the debate, with the moderator saying Biden would be 86 by the end of a potential second term, and Trump 82.

Biden defended his age, saying he ‘spent half my career being criticized about being the youngest person in politics. I was the second-youngest person ever elected to the United States Senate, and now I’m the oldest. This guy is three years younger and a lot less competent.’

Trump, meanwhile, said he had taken cognitive tests and ‘aced them.’

The debate unleashed panic among Democrat allies of the president and members of the media, as they remarked his performance was a failure that added fuel to the fire surrounding concerns over his mental acuity and age.

‘My phone really never stopped buzzing throughout. And the universal reaction was somewhere approaching panic,’ then-MSNBC host Joy Reid, for example, said.

‘My job now is to be really honest,’ former Missouri Sen. Claire McCaskill, a Democrat, said during an appearance on MSNBC after the debate. ‘Joe Biden had one thing he had to do tonight, and he didn’t do it. He had one thing he had to accomplish and that was reassure America that he was up to the job at his age. And he failed at that tonight.’

‘I think the emotions of the night were basically disappointment, anger, and then, by the end, it was panic,’ one House Democrat who was granted anonymity to speak freely, told Fox News Digital following the debate.

Legacy media outlets such as the New York Times and the Chicago Tribune called on Biden to map out an exit plan – with the Times describing Biden as a ‘shadow of a great public servant’ – while Biden allies such as former President Barack Obama and first lady Jill Biden reiterated their support for the 46th president’s re-election.

‘Bad debate nights happen. Trust me, I know,’ Obama said the day after the debate. ‘But this election is still a choice between someone who has fought for ordinary folks his entire life and someone who only cares about himself. Between someone who tells the truth; who knows right from wrong and will give it to the American people straight – and someone who lies through his teeth for his own benefit.’

Soon after the debate, however, reports spread that Obama was working behind the scenes to rally that Biden drop out of the race, so a new generation of Democrats could take the reins of the party.

The White House, meanwhile, forcefully defended the president following the debate.

‘Absolutely not,’ then-White House press secretary Karine Jean-Pierre declared in a media briefing July 3, 2024, when asked if Biden had any plans to exit the 2024 race.

Biden ultimately did drop out of the race on July 21, 2024, less than a month following the debate, as pressure from traditional allies grew. The president announced his departure in a Sunday afternoon message posted to his X account.

The announcement was soon followed by him endorsing Vice President Kamala Harris to take up the mantle, leaving her with just more than 100 days to launch her own presidential campaign against Trump.

This post appeared first on FOX NEWS